family that I love spending time with; my 6-year-old daughter and 3-year-old son are so much fun, and as all of you parents know, it takes a LOT of time to actively be engaged in our children’s lives (which is a GOOD thing).

This is not only a problem for those in the military, it’s a challenge for anyone who has a full-time job and a family. Having a side-hustle is difficult, especially if it requires an active role (i.e. trading time for money). Therefore, many try to build streams of passive income in order to “create” more time for themselves and their family. Heck, I’ve been searching and trying to create passive income streams for almost 13 years now!

Passive income is defined by Investopedia as “earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved”; in other words – “money being earned regularly with little or no effort on the part of the person receiving it”.

That sounds really nice, right?! But, don’t let the definition fool you. ALL forms of passive income require WORK to get you there. And, ALL passive income will require some level of WORK to keep it. I really love Gary Vaynerchuck’s rant on passive income. Now, I think he is primarily talking about all of these internet scams that people fall into, but in general, he’s right! There is no such thing as true passive income: receiving money for doing ZERO work does not exist. However, I’d argue that there are certain types of passive income that are more passive than others; hence, the levels of passivity. Now, I’m going to keep this simple and focus solely on different ways that you can make money through real estate. Most of these strategies I’ve tried personally so I’ll do my best to give pros and cons on each. Remember – this isn’t a comparison of how good or bad the investment strategy is; we are talking solely on how passive (or not) the investment is. We’ll keep the levels between 1 and 10. We’ll say that Level 1 is as about as passive as you can get (lowest amount of work required) and Level 10 is about as active as you can get. Here we go:

Level 1

Real Estate Investment Trusts (REITs) – A real estate investment trust is a company owning and typically operating real estate which generates income. Many are publicly traded on the stock exchange, however not all are publicly traded. All must be registered with the SEC. Crowdfunding platforms can fall into this category as well. The idea is that you can invest a small portion of your money to share in a larger portfolio of real estate and earn dividends or interest on your money.

Pros – in the grand scheme of things it’s pretty passive. The money that you worked for and saved gets invested and you then watch (and hope) the company you invested with does well with your money.

Cons – you have zero control once you’ve invested your money. You are basically hoping the company does well. Also, there are very little tax advantages to this investment, unless you are investing inside of a 401k or IRA. Lastly, you typically get a lower return on your money.

Level 2

Investing in Syndications as a Limited Partner – similar to crowdfunding platforms, you are investing your money into a group ownership of an entity that owns the real estate. You then share in the profits that are produced by the asset.

Pros – this is also somewhat passive; however, it does take a little more time to properly do your own due diligence on the asset itself, and the team (or person) you are investing with. You should always do your own research on the deal and the General Partner. Once you invest, you don’t have to do much else besides maybe occasionally follow up (if the General Partner doesn’t do a good job with communication). Also, you will typically get a better return on your money than a

REIT (if the operator and asset perform), and you have more tax advantages because you typically will get a K-1 statement with tax deductions built in.

Cons – very little control once you’ve invested your money. As a limited partner you have very little say on how to operate the asset. You also risk much more than investing in a REIT because you are solely relying on the operator (GP) performing. Additionally, you don’t have much else to protect you if the deal goes bad. You will typically sign a PPM that says you understand the risk you are taking by investing in the syndication. You have the potential to lose it all.

Level 3

Performing Mortgage Notes – you become the bank. Like Wells Fargo, you are the mortgagee, secured by a recorded lien on the property. You receive the monthly mortgage payments from the owner of the house, just like a traditional bank would if they were the lender.

Pros – this strategy takes a little bit of time to find and buy from respectable mortgage note originators (unless you are creating the note yourself, which takes even more time). Due diligence is the primary factor for being less passive than a REIT. Once you have invested and the mortgage note is performing, you have very little else to do but watch the monthly payments come into your account. Traditionally, your ROI is pretty good as well (10-12%) and have much more control on choosing your investment.

Cons – very little tax advantages unless you are using a 401k or IRA. Also, if the mortgage note stops performing (i.e. the owner of the home stops paying the mortgage), it can be quite the hassle to foreclose on the property.

Level 4

Private/Hard-Money Lending (short term) – you lend money to flippers, wholesalers, and business owners for shorter term agreements. This is typically done through promissory notes, or mortgage notes.

Pros – similar to mortgage note investing, most of the time required is on your due diligence period, prior to investing. Not only do you need to ensure the operator will perform, you need to ensure the numbers make sense on the deal itself. Once your money is working, you typically don’t have to do much else besides the occasional follow-up. Traditionally, your ROI is better than a mortgage note because you can charge higher interest rates and points. Also, you have much more control on choosing your investment.

Cons – very little tax advantages unless you are using a 401k or IRA. Also, just like a mortgage note, if the deal goes south, it will require a significant amount of time to either foreclose on the property, or sue the investor for your loss (on the occasion you only did a promissory note). These types of investments will also typically require a little more paperwork because they happen more frequent (i.e. the terms of the loans are for shorter periods of time).

Level 5

Buying rental property with property management in place – many will call this “turnkey” investing, but you don’t have to use a turnkey company to do this strategy. However, if you are buying property out of state, site unseen, it’s probably best to use a reputable turnkey company that has a team and system in place to help when things go bad.

Pros – you are relying on a professional company to manage your property for you. This requires way less time and attention than if you were managing the property yourself. However, this doesn’t mean you can just wipe your hands clean and never do anything once you’ve purchased the property. You should probably continue to follow-up and “manage the manager” because nobody will ever take as much care and pride as you will when it comes to ensuring your rental property performs. Additionally, you have many more tax advantages to owning actual

property, which increases your overall ROI. Plus, you have much more control on how the asset performs.

Cons – due to the nature of physical real estate, there is much more of a roller coaster effect in this type of investing. You will have good years and bad years, completely dependent on maintenance, capital expenditures, vacancies, and property management performance. Some times you have GREAT returns; other times you may have negative returns.

Level 6

Buying non performing mortgage notes – just like performing notes, you become the bank. However, you are buying a note where the home-owner has stopped paying and is in default. Because of this, you are buying the note for often times pennies on the dollar, and your goal is to get it performing again so you can reap the benefits of such a discount.

Pros –Once you get the note to perform, you can sit back and watch the monthly payments come in. Also, your ROI goes through the roof since you bought the note at such a discount.

Cons – this takes way more work on the front side to get the mortgage note performing again, or going through the foreclosure process if you can’t get the note to perform. Additionally, it takes a significant amount of work to actually find where to buy these non-performing notes. You typically have to work directly with banks and that alone can be a challenge. And, similar to mortgage notes and private lending, you have very little tax advantages unless you are investing through your 401k or IRA.

Level 7

Buying rental property and self-managing – more than likely you are doing this to save money by not having to pay a property management fee and the investment is local to where you live.

Pros – save money on property management fees (maybe). Also, you have many more tax advantages when owning physical property, which increases your overall ROI. And, you have ALL the control on how your asset performs.

Cons – this will require significantly more work, especially if you have a needy tenant, or old property that requires significant maintenance. If the tenant and asset perform well, it can be somewhat passive. However, it can quickly become a major headache if it goes south.

Level 8

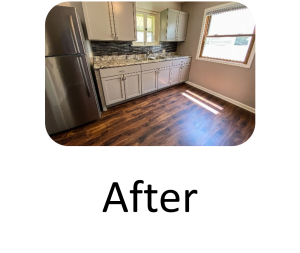

BRRR Investing (buy, rehab, rent, refinance) – buying a property that needs repairs (typically requiring cash), then renting the property and refinancing into a conventional loan once the rehab is complete. This strategy comes in many stages and all require quite a bit of time and due diligence.

Pros – you have ALL the control on how the investment performs. Additionally, you have many tax advantages and your ROI can be significantly higher if you perform well.

Cons – this takes quite a bit of work, but it can be done. Coordinating and managing the rehab is where most of the time will be spent. Once the rehab is complete, your time can be decreased by hiring a property manager for the rental property.

Level 9

Syndicating commercial (or residential) property as the General Partner –you are raising money and pooling funds to buy and operate a large commercial property, or a portfolio of residential property.

Pros – you have ALL the control on how the investment performs. Additionally, you have many tax advantages and your ROI can be significantly higher if you perform well.

Cons – this takes a lot of work. Raising money, investor relations, and operating a commercial property requires a significant amount of time. Most who do it well, do it as their full-time job. Unless you have a large team where roles can be broken up, this is hard to do as a side-hustle when having a full-time job.

Level 10

Wholesaling & Flipping Houses – finding great deals at a significant discount and either assigning them to another investor, or rehabbing the property yourself and selling the finished product to investors or retail buyers.

Pros – you have ALL the control and your ROI can be HUGE!

Cons – there is nothing passive about this strategy. This is a business that must be run properly. However, if you are able to grow and scale and hire people within the business to take over, it can eventually become passive if you are the CEO of the company and your team is engaged in the daily tasks. Additionally, this strategy has very little tax advantages. In fact, you probably get taxed the highest by doing this strategy, but your ROI may be worth it.

That’s it! Hopefully this helps you understand realistically how passive (or not) some of the real estate investing strategies can be. Hopefully this will also help you decide what strategy may be best for you, depending on how much time is required from your full-time job and family dynamic.

Lastly, David and I want to help you with your own investing strategy as we continue to find new opportunities to invest in ourselves. We are always looking for more partners and can offer quite a few of the strategies listed above. If you are interested in partnering with us, let’s schedule a call! Here are the links to our calendars:

David’s schedule: https://calendly.com/dmgutierrez21

Stuart’s schedule: https://calendly.com/grazierinvest/30min